What is an Actuary?

All actuaries often get asked the same question – “What is an actuary?” It is a straightforward question without a straightforward answer.People generally know that actuaries work in the insurance industry but what is it that an actuary really does? If you have a life insurance policy, you’ll have to pay premiums regularly to your insurance company in exchange for the financial protection that the company is providing you. Have you ever wondered who calculates the amount of premium you have to pay?

Actuaries build and use mathematical models based on statistical data to calculate the appropriate amount of premiums to charge policyholders. This will require projections of how events will unfold in the future. In calculating the right amount of premiums, the actuary will need to project how large potential claims will be and when they will occur.

Such projections are incorporated into the models to calculate the premium required. At the same time, judgement, business

Calculation of premiums is only one of the many contributions of actuaries to insurance companies. In addition to pricing decisions, actuaries are involved in designing insurance products, formulating investment strategies, determining reserves to be set up to meet future claims and recommending distribution of profits to shareholders after taking into account the insurance company’s future obligation to policyholders.

Actuaries also estimate the amount of future claims by analysing past data or experience to assign probabilities to events such as death, sickness, disability, loss of property or even loss of business profits.

Actuaries provide solutions to today’s insurance and financial problems that properly take into account the financial impact of future events. With the actuaries’ expert knowledge in financial matters, they are often key advisors to the Board of Directors.

An actuary’s job is not just boring desk-bound number crunching. Actuaries are faced with challenges of the ever-changing

- After I finished my SPM, I felt confused about my further study. Because of Eduspiral, I am able to pursue my studies at Asia Pacific University. Eduspiral, was so patient to answer all my questions and even brought me to visit the university when I went to KL alone. Jeremy Lee, APU scholarship student

It is an intellectual challenge to analyse current trends and predict the future as we live in a world where the unexpected (e.g. the SARS outbreak, September 11 etc.) can happen.

Due to the demand for actuarial technical skills and knowledge, there are vast career options and opportunities for an actuary. Traditionally, actuaries worked only in the insurance industry.

However, with the growing acknowledgement and recognition of actuarial skills today across the various financial sectors, the potential employment opportunities of an actuary have expanded to encompass banks, investment companies, security and commodity broker firms, regulators and even lecturing in the education sector. With such demand, there is an ever-increasing need for actuaries all around the world.

In Malaysia, most actuaries are still working in the traditional life and non-life

insurance industry. However, based on trends worldwide and the rapid growth of the Malaysian financial industry, it is expected that more and more actuaries will ventured into the non-traditional areas as mentioned above.

insurance industry. However, based on trends worldwide and the rapid growth of the Malaysian financial industry, it is expected that more and more actuaries will ventured into the non-traditional areas as mentioned above.For an actuary, being good in mathematics is a must. However, actuaries must also have good verbal and written communication skills, strong computer skills, time-management skills, as well as possess good judgement, imagination and clear logical thinking.

They also should have a knack for problem-solving, be self-confident, and possess the ability to work under pressure. Sharpness, creativity, practicality coupled with good business sense are also some of the key personal attributes. An actuary who has devised a brilliant solution to complex problem must be able to explain his solution to non-actuaries!

By and large, the rewards are good. It is no secret that an actuary is one of the higher paid jobs. Of course, salaries can vary according to company policy and market forces of supply and demand. Actuaries have excellent promotion opportunities as they

Summarising it all, don’t even think about being an actuary if one, you hate numbers and two, you don’t enjoy problem-solving! En route to full qualification, there are many hurdles to overcome. But for those who persevere and qualify, the rewards are well worth the effort and self-satisfaction plenty.

References Ravinderen, K.E., “A day in the life of risky business”, The Malay Mail, pg. 15, November 12, 2001 . Chen, Mary, “What does an actuary actually do?”, Sunday Mail, pg. 47, April 18, 2004 .

What does an Actuary do?

Basically an Actuary calculates the amount of premiums to charge to a policyholder using mathematical models based on statistical data from the past. Since we are not able to predict the future, the actuary has to use mathematical models to make projections as accurate as possible on the chances that disease, accidents or death will occur to a person at a particular age and the potential for claims.

Then the insurance company is able to charge the premium for the financial protection. For example, a premium for a young male driver would be higher as the risks are higher as compared with an experienced driver or the premium for a non-smoker is lower because of the lower health risk.

In short, actuaries use and analyse historical data using mathematical models to come up with projections on the chances of something happening in order to formulate the pricing.

Actuaries are also involved in designing insurance products, formulating involved in designing insurance products, formulating investment strategies, determining reserves to be set up to meet future claims and recommend distribution of profits to shareholders taking into account the insurance company’s future obligation to policyholders.

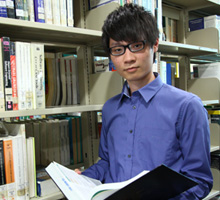

Future job prospects for actuarial science professionals in Malaysia

The Actuarial Society of Malaysia observed that with the expected continuous growth in the insurance market, the demand for- Given the expected continuous growth in the insurance market, it is anticipated that the demand for actuaries in Malaysia will continue to grow in the next few decades.

- Future regulatory developments (e.g. requirement for certification of IBNR) and the increasing need for risk management are likely to result in significant increase in demand for actuarial services by general insurers.

- With only 100 qualified actuaries in Malaysia, the market for actuaries can perhaps still be considered unsaturated.

What are the rewards for actuarial science graduates?

- Financial – qualified actuaries have significantly higher salaries than most other professionals in the financial services industry. In addition, due to increments commonly offered for exam progress, actuarial executives can expect to outperform their peers in other sectors even before qualifying.

- Intellectually stimulating – actuaries are rewarded for their problem solving and analytical skills. As such, job satisfaction comes from working in an intellectually stimulating and challenging environment. This encourages continual growth in one’s technical skill and ability, paving the way to involvement at senior levels of all organisations.

- Employment opportunities – due to the constant demand for actuaries exceeding supply, there is rarely ever a shortage of demand for actuaries. Many actuaries have also successfully transitioned to other non-traditional areas such as corporate finance and investments, where their analytical and quantitative skills are highly sought after.

Who should become an actuary and what attributes would be of help?

To become an actuary, you will generally need to have a high-level of mathematical ability and an above-average level of intelligence. Important characteristics for an actuary to have would be as follows:- Interest in solving complicated problems.

- Interest in business, finance and economics.

- Good oral communication skills.

- Good written communication skills.

- Perseverance (especially in tackling the exams!!!).

Where do most actuaries work in Malaysia?

Actuaries are normally found in the insurance industry. They also work in consulting, financial institutions, banks, investment,brokerages, or as lecturers.

The American Society of Actuaries defines actuaries as ‘professionals who provide expert advice and relevant solutions for business and societal problems that involve economic risk.’ In Malaysia, one of the places where actuaries are often found is at insurance companies. Using mathematical models based on statistical data, they are the brains behind the calculation of the amount of insurance premium that a policyholder has to pay.

With their readily transferable skills, actuaries can also be found in many other fields. Besides the hugely popular insurance field, an actuary can work in finance, marketing, manufacturing or in the development of new products.

For example, an actuary might be hired by a business to help determine where it

should invest its money based on risk and potential return analysis. Opportunities for actuaries range from the education industry to research work and even to government agencies. Because of the importance of their work, actuaries are respected throughout

the business community.

In Malaysia, most actuaries can be found in life insurance companies, financial institutions such as banks, consultancies providing advice in the fields of employee benefits, life insurance and general insurance, Bank Negara Malaysia and public universities.

The areas of work for actuaries are not limited to insurance firms only. Instead, the horizon for this line of job is very wide. Below are some of the areas of work which actuaries do:

- Life Insurance / Family Takaful

- General Insurance / General Takaful

- Reinsurance / Retakaful

- Actuarial Consulting

- Investment and Financial Services

- Employee Benefit Industry (e.g. EPF)

- Government Sector (e.g. BNM)

- Colleges and Universities

What are the career options available to actuaries?

Actuaries have historically taken on the following positions in companies:- Chief Executive Officer (CEO)

- Chief Risk Officer (CRO)

- Chief Financial Officer (CFO)

- Appointed Actuary / Signing Actuary

- Asset/Investment Consultant

- Management Consultant

Actuaries Salary and Career Opportunities in Malaysia

Actuaries are well compensated. Experienced fellows have the potential to earn from USD$150,000 to USD$250,000 in the USA annually, and many actuaries earn more than that.According to the 2015 Robert Walters Salary Report, the salary for an actuary in Malaysia is:

| 4 - 7 Years Experience | 8 - 12 Years Experience | 12+ Years Experience | |||

| Actuaries salary | 72 - 120k a year | 96 - 204k a year | 204k+ a year |

The actuarial profession is perfect for individuals who enjoy challenges and problems solving.

Those who develop a track-record of success will have many opportunities for growth and advancement.

Most employers of actuaries award merit increases as you gain experience and pass the actuarial examinations. Most companies also offer cash bonuses, salary increases, and promotions for each professional designation achieved.

Skills acquired by actuaries, especially the quantitative analysis of risk, are valued in the marketplace. As such, those who have the will to succeed can aspire to career advancement with an actuarial credential.

Please fill up the form for more information. If you do not give your mobile number or full name as in IC, your query will not be answered. Please make sure you give a correct email address and check your email including the SPAM or JUNK email folder within 48 hours as we will email you the information.

[contact-form subject='[EduSpiral Consultant Services - Education advise on the best universities %26amp; colleges in Malaysia%26#x002c; Hong Kong%26#x002c; Singapore and UK The top universities and colleges in Malaysia offering the best courses'][contact-field label='Full Name as in IC. (If you are the parent%26#x002c; please give the child%26#039;s name)' type='name' required='1'/][contact-field label='Email' type='email' required='1'/][contact-field label='Hand Phone Number' type='text' required='1'/][contact-field label='Qualification (SPM%26#x002c; A-Levels%26#x002c; STPM%26#x002c; UEC%26#x002c; etc)' type='text'/][contact-field label='Course of Interest/Remark' type='textarea' required='1'/][/contact-form]

The work of an actuary in Malaysia

Combining their skills in mathematics, statistics, economics and finance, actuaries are able to gauge and make expert financial predictions about the future.Actuaries can specialise in the following fields:

- Traditional life insurance

- They focus on the analysis of mortality, the production of life tables and the application of interest to produce life insurance, annuities and endowment policies. It also includes credit and mortgage insurance, long term care insurance and health savings account.

- Health insurance

- They focus on the analyses of rates of disability, morbidity, mortality, fertility and other contingencies. Also of great importance are the effects of consumer choice and the geographical distribution of medical services as well as the procedures and use of drugs and therapies.

- Pension industry

- They measure costs of alternative strategies with regards to the design, maintenance or redesigning of pension plans. The strategies are greatly influenced by collective bargaining, the changing demographics of the workforce, changes in internal revenue code and financial and economic trends among others.

- Property and casualty

- They focus on data collection, measurement, estimation, forecasting and valuation tools to provide financial and underwriting data for management to assess marketing opportunities and the required degree of risk taking.

- Reinsurance

- Focus on designing and pricing reinsurance and retro-reinsurance schemes. Their responsibility also includes establishing reserve funds for known claims and future claims as well as catastrophes.

The pathway to become a professional Actuary in Malaysia

The path to becoming an actuary involves going through a well-structured education plan. This involves university-levelStudents after SPM, can go for the Foundation and then degree programs in Actuarial Science with exemptions from the professional papers. Upon completing the degree, students can then begin to take the professional exams.

How long does it normally take to become an Actuary in Malaysia?

A normal bachelor degree takes 3 years (+1 year if you consider an Honours degree in Australia). Thereafter, writing the professional exams through the Institute (London) or Faculty (Scotland) of Actuaries or Society of Actuaries (US) or Institute of Actuaries of Australia takes an average of 3-7 years (working and studying) after the degree.

Actuarial Science/Math Degree (3-4 years) + Professional Papers (3-7 years taken part time as you work)

Qualifying to become a professional Actuary in Malaysia

In Malaysia, to be recognised as an actuary, one will have to be a registered member with the Actuarial Society of Malaysia (ASM).

What kind of support do local and foreign companies provide?

Most, if not all local and foreign companies support their actuarial students by having actuarial development programs with the following incentives:

- Study and exam leave

- Full/partial reimbursement on costs of study material

- Salary increment and/or bonus upon passing of exams

Which actuarial professional bodies are recognized in Malaysia?

Malaysian insurance regulator, Bank Negara Malaysia and the Actuarial Society of Malaysia (ASM) recognize Fellows of the following organizations as qualified actuaries:- Society of Actuaries (U.S.)

- Institute and Faculty of Actuaries (UK)

- Faculty of Actuaries (Scotland)

- Institute of Actuaries of Australia

- Canadian Institute of Actuaries

- Casualty Actuarial Society (U.S.)

Where to study Actuarial Science degree in Malaysia?

Students can consider studying the BSc (Hons) Actuarial Science at UCSI University or obtain a Staffordshire University, UK degree locally in Malaysia at Asia Pacific University graduating with the BSc (Hons) Actuarial Studies.The best university in Malaysia for Actuarial Science would be Heriot-Watt University Malaysia where students can get 8-paper exemptions out of 15 needed to qualify as a Fellow at the Institute and Faculty of Actuaries (FIA), UK.

What are the passing rates like?

Passing rates are generally low compared with other professions.

For the Institute, Society or Faculty professional exams, passing rates as low as 15% - 25% per subject are not uncommon.

What about exams and qualifications for Actuary?

- The ASM does not conduct its own exams but actuarial students in Malaysia have a choice of taking any of the USA, U.K. or Australian exams from the above professional bodies.

- The current structure for the respective exam series is briefly described below:

- Society of Actuaries (U.S.)

- 5 Preliminary Exams

- Validation by Educational Experience (VEE) - 3 subjects

- Fundamental Actuarial Practices (FAP) - 8 modules + 2 assessments

- Associateship Professionalism Course

- FSA Module - 2 Modules

- FSA Exams - 2 Exams

- Strategic Business Management Module

- Fellowship Admissions Course

- Institute of Actuaries (U.K.)

- CT series exams - 9 papers

- CA series exam - 3 papers

- ST series exams - choose 2 papers from 6 areas of specialization

- SA series exam - choose 1 paper from 6 areas of specialization

- Professionalism course

- Experience requirement

- Institute of Actuaries of Australia

- Part 1 (equivalent to UK 100 series exams)

- Part 2 - 2 half-year subjects

- Part 3

- 2 compulsory papers

- Another 2 papers from a specific practice area (choose 1 from 4 areas of specialization)

- Practical Experience Requirement & Mentor program

- Professionalism course

- Society of Actuaries (U.S.)

Society of Actuaries (SOA) - USA

Route to Becoming an Actuary throught the Society of Actuaries professional exams – SOA1. Preliminary Education Component

Consists of five papers:

- Exam P Probability (same as CAS Exam 1)

- Exam FM Financial Mathematics (same as CAS Exam 2)

- Exam MLC Actuarial Models – Life Contingencies Segment

- Exam MFE Actuarial Models – Financial Economics Segment (Completion of MLC and MFE will entitle candidate credit for CAS Exam 3)

- Exam C Construction and Evaluation of Actuarial Models (same as CAS Exam 4)

Validation of these topics is required in addition to the four Preliminary Education examinations (P/1, FM/2, MCL, MFE and C/4). The SOA, CIA, and CAS have implemented VEE requirements for the following topics:

- VEE – Applied Statistical Methods

- VEE – Corporate Finance

- VEE – Economics

Candidates with credit for Course 4 earned prior to 2005 have been given credit for VEE – Applied Statistical Methods.

NOTE: VEE topics are not prerequisites for the preliminary examinations. They need not be completed prior to writing any of the preliminary exams and may be fulfilled independently of the preliminary exam process.

Credit for VEE can be obtained through various courses completed from colleges or other education programs.

3. Fundamentals of Actuarial practice (FAP)

Web-based course comprising eight modules and two assessments:

Modules:

- Module 1 – Introduction / The Role of the Professional Actuary

- Module 2 – Core External Forces

- Module 3 – Risk in Actuarial Problems

- Module 4 – Actuarial Solutions

- Module 5 – Actuarial Models

- Module 6 – Model Selection and Solution Design

- Module 7 – Selection of Initial Assumptions

- Module 8 – Monitoring Results and Completing the Control Cycle

- First Assessment upon completion of Modules 1 to 5

- Final Assessment upon completion of Modules 6 to 8

Half day course covering professionalism, ethics and legal liabilities.

Upon completion of the Preliminary Education Component, VEE, FAP and ACP, the candidate will obtain the title of Associate of the SOA (ASA).

5. Fellowship Courses (Will be changed in July 2013)

To proceed from Associate to Fellow in the SOA, additional courses have to be completed:

- Two FSA Modules in one specialty track

- One Company / Sponsor Perspective (CSP) paper and One Design and Pricing (DP) paper from one of the following areas:

- Finance: Advanced Finance and ERM (CSP) / Financial Economic Theory (DP)

- Enterprise Risk Management (ERM): Advanced Finance and ERM (CSP) / Financial Economic Theory (DP)

- Investments: Advanced Portfolio Management (CSP) / Financial Economic Theory (DP)

- Group and Health: Group and Health CSP Exam / Group and Health DP Exam

- Individual Life and Annuities: Individual Life and Annuities CSP Exam / Individual Life and Annuities DP Exam

- Retirement Benefits: Retirement Benefits CSP Exam / Retirement Benefits DP Exam

- Decision Making and Communication (DMAC) Module

Casualty Actuarial Society (CAS) – United States

In general, CAS has a similar preliminary exam structures as SOA. Candidates are required to complete the following three VEE subjects:- VEE – Applied Statistical Methods

- VEE – Corporate Finance

- VEE – Economics

There are 9 exams to be taken with the first four (Exams 1, 2, 3 and 4) being equivalent to the first part of the SOA exam structure.

- Exam 1 Probability (same as SOA Exam P)

- Exam 2 Financial Mathematics (same as SOA Exam FM)

- Exam 3 Statistics and Actuarial Models (same as SOA Exams MLC + MFE)

- Exam 4 Construction and Evaluation of Actuarial Models (same as SOA Exam C) At this point, students interested in Life Insurance can opt to continue with the SOA path.

- Exam 5 Introduction to Property and Casualty Ratemaking

- Exam 6 Reserving, Insurance Accounting Principles, Reinsurance, and Enterprise Risk Management

- Exam 7 Nation Specific: Annual Statement, Taxation, and Regulation (Canada and USA)

Upon completion of all the above requirements, candidate will be admitted as an Associate of the Casualty Actuarial Society (ACAS).

- Exam 8 Investments and Financial Analysis

Institute of Actuaries / Faculty of Actuaries (F&IA) - United Kingdom

Graduates from Heriot-Watt University Malaysia are able to gain exemptions from 8 of the 15 professional papers from the Institute and Faculty of Actuaries, UK.Core Technical (CT) Stage

Comprises of eight papers and a business awareness modules:

- *CT1 - Financial Mathematics

- *CT2 - Finance and Financial Reporting

- *CT3 - Probability and Mathematical Statistics

- *CT4 - Models

- *CT5 - Contingencies

- *CT6 - Statistical Methods

- *CT7 - Business Economics

- *CT8 - Financial Economics

- CT9 - Business Awareness Module

Core Applications (CA) Stage

Comprises of one paper and two modules (CA2 and CA3) involving attendance at a 2-day residential course. Distant learning modules for CA2 and CA3 may be offered for candidates who are unable to attend the residential course.

- CA1 Actuarial Risk Management

- CA2 Model Documentation, Analysis and Reporting

- CA3 Communications

Specialist Stage

Requires completion of two Specialist Technical (ST) papers and one Specialist Applications (SA) paper:

- Specialist Technical subjects:

- ST1 Health and Care

- ST2 Life Insurance

- ST4 Pensions and Other Benefits

- ST5 Finance and Investment A

- ST6 Finance and Investment B

- ST7 General Insurance: Reserving and Capital Modelling

- ST8 General Insurance: Pricing

- ST9 Enterprise Risk Management

- Specialist Applications subjects:

- SA1 Health and Care

- SA2 Life Insurance

- SA3 General Insurance

- SA4 Pensions and Other Benefits

- SA5 Finance

- SA6 Investment

Practical experience requirement monitoring the development of the candidate in several key areas, supervised by an approved mentor. A minimum of three years’ actuarial work experience is required before being admitted to Fellowship.

Upon completion of the above, the candidate may be admitted as Fellow.

UK Practice Modules

A multiple choice examination testing the candidate’s knowledge in the general principles of UK Financial Services, business practices, regulation, legislation and professional guidance notes. Not required to qualify as a Fellow, but required if practising in the UK in a reserved role.

Institute of Actuaries of Australia (IAA) - Australia

Part IIdentical to the CT1 to CT8 of the Core Technical Stage in the Faculty and Institute of Actuaries (UK) program. They can either

be completed by sitting for examinations directly from the Institute or via courses from the following universities:

- Australia National University, Canberra

- Macquarie University, Sydney

- University of Melbourne, Melbourne

- University of New South Wales, Sydney

The Actuarial Control Cycle – This part comprises of two papers. They can only be completed through courses from the above mentioned universities. Upon completion of Part I and Part II, the candidate will gain the status of Associate of the IAAust (AIAAust).

Part III

Four papers which have to be taken directly from the Institute:

- Module 1 – Investments (Compulsory)

- Module 2 and 3 – Choice of:

- Life Insurance (Part A and B)

- General Insurance (Part A and B)

- Superannuation and Planned Savings (Part A and B)

- Investment Management and Finance (Part A and B)

- Module 4 – Commercial Actuarial Practice (Compulsory)

Two-day residential course, highlighting the obligations, risks and legal responsibilities of being a member of the IAAust.

Practical Experience & Mentor Program

To fulfil the one-year practical experience requirement under the supervision of an approved mentor.

How many Professional Actuaries are there in Malaysia?

Actuarial Society of Malaysia (ASM) Society Statistics As at 31 December 2014

Membership in the Actuarial Society of Malaysia (ASM) Breakdown by Class

| Class | Total |

| Fellow | 121 |

| Associate | 45 |

| Ordinary | 504 |

| Student | 38 |

| Total | 708 |

Membership in the Actuarial Society of Malaysia (ASM) by Professional Body

| Professional Body | Total |

| Society of Actuaries | 391 |

| Institute & Faculty of Actuaries | 195 |

| Institute of Actuaries of Australia | 45 |

| Casualty Actuarial Society | 39 |

| Others | 38 |

| Total | 708 |

Membership Breakdown of the Actuarial Society of Malaysia by Employment Category As at 31 December 2014

| Employment Category | Total |

| Life Insurance | 217 |

| Takaful | 122 |

| Composite Insurance | 105 |

| Consulting | 94 |

| Regulator | 39 |

| General Insurance | 38 |

| Reinsurance / Retakaful | 26 |

| Others | 14 |

| Total | 655 |

Actuaries Salary and Career Opportunities in Malaysia

Actuaries are well compensated. Experienced fellows have the potential to earn from $150,000 to $250,000 annually, and many actuaries earn more than that.According to the 2015 Robert Walters Salary Report, the salary for an actuary in Malaysia is:

| 4 - 7 Years Experience | 8 - 12 Years Experience | 12+ Years Experience | |||

| Actuaries salary | 72 - 120k a year | 96 - 204k a year | 204k+ a year |

There are four membership classes under the ASM:

- Fellow

- Associate

- Ordinary

- Student

Fellow

To join, professionals must be a Fellow of one of the following bodies:

- Society of Actuaries (USA)

- Casualty Actuarial Society (USA)

- Faculty and Institute of Actuaries (UK)

- Institute of Actuaries of Australia (Australia)

- Canadian Institute of Actuaries (Canada)

- Recommended by 2 Fellow members of the Society

- Resident in Malaysia or deemed to be familiar with Malaysian conditions

- At least 1 year’s experience in the Malaysian actuarial industry

To join, professionals must be an Associate of one of the following bodies:

- Society of Actuaries (USA)

- Casualty Actuarial Society (USA)

- Faculty and Institute of Actuaries (UK)

- Institute of Actuaries of Australia (Australia)

- Canadian Institute of Actuaries (Canada)

- Passed examinations of any professional actuarial bodies to be recognized as Fellow, which is deemed to be at least equivalent to the examination requirements to become an Associate of the above actuarial bodies.

Ordinary

- Satisfies one of the following:

- Ordinary member of a professional actuarial body; OR

- Passed at least 1 part/subject of the examinations of a professional actuarial body which has no class of Ordinary membership and is continuing to study for other examinations of the actuarial body; OR

- Completed an actuarial course or other related statistical course in a university, college or other academic institute and has achieved a qualification thereof; OR

- Carrying out actuarial or other related work in a life or non-life insurance company, government office or actuarial consulting office.

Student

- Nominated by 2 persons delegated by the Vice Chancellor of the university

- Does not meet the requirements for admission as Fellow, Associate or Ordinary member; OR meets the requirements but is not gainfully employed and chooses to seek Student membership

- Has a declared interest in actuarial matters

- Undergraduate/postgraduate student in an actuarial-related program

- Actuarial Society of Malaysia (www.actuaries.org.my)

- Society of Actuaries (www.soa.org)

- Faculty & Institute of Actuaries (www.actuaries.org.uk)

- Institute of Actuaries Australia (www.actuaries.asn.au)

- Canadian Institute of Actuaries website (www.actuaries.ca)

- Casualty Actuarial Society (www.casact.org)

EduSpiral Consultant Services- Your Personal Online Education Advisor

Established since 2009, EduSpiral Consultant Services helps provide information and counselling on courses and

private universities in Malaysia. EduSpiral Consultant Services also represents Northampton University, UK, MDIS Singapore and Hong Kong Polytechnic University.

EduSpiral Consultant Services represents the best colleges and universities in Malaysia offering a wide range of choices for students to choose from. These colleges and universities offer value for money in the quality of education and excellent facilities that you get.

These universities and colleges are chosen by EduSpiral because they represent the best in their fields in Malaysia and affordable. EduSpiral provides in-depth information and counseling on their courses so that students are able to make the right choice.

If you are still not sure what to study, please contact us and we will send you a free EduSpiral Career Assessment Form.

Please contact us for more details.

- Whatsapp: +601111408838

- Wechat/Line: Eduspiral88

- Instagram: www.instagram.com/eduspiral

- Foursquare: www.foursquare.com/eduspiral

- Youtube: www.youtube.com/eduspiral

- Follow EduSpiral: www.twitter.com/eduspiral

- Be my friend: www.facebook.com/eduspiral1

- Like EduSpiral: www.facebook.com/eduspiralcs

- Message me: info@eduspiral.com

- Website: www.eduspiral.com

No comments:

Post a Comment

Please leave your comments and questions